how to calculate pre tax benefits

For 2022 the standard mileage rate is 585 cents per mile. For example youre paid biweekly and earn 45000 annually.

How To Get A Pre Approved For A Mortgage Mortgage Approval Mortgage Debt To Income Ratio

Pre-tax health insurance plans include.

. Pre-EMI is only the interest paid during the period. You can use the cents-per-mile rule if either of the following requirements is met. 501c3 Corps including colleges universities schools hospitals etc.

Personal use is any use of the vehicle other than use in your trade or business. Generally health insurance plans that an employer deducts from an employees gross pay are pre-tax plans. See What Credits and Deductions Apply to You.

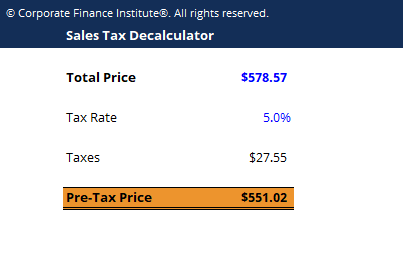

First subtract the 50 pre-tax withholding from the employees gross pay 1000. This is the formula for calculating pre-tax income. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes.

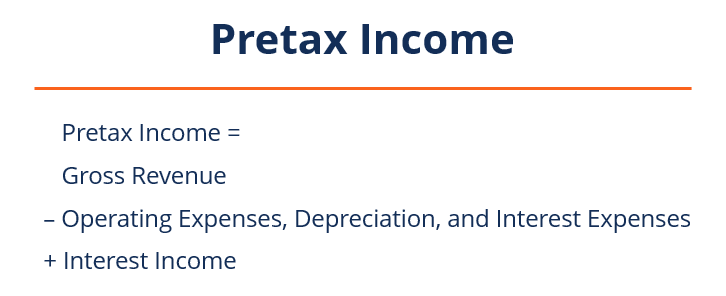

403b Savings Calculator 403b plans are only available for employees of certain non-profit tax-exempt organizations. It provides you with two important advantages. Pre-tax income often known as gross income is your total income before you pay income taxes but after deductions.

But thats not always the case. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period. Ad Find 100s of Local Tax Experts.

This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA. Refer to the employees Form W-4 and the IRS tax tables for that year to calculate and deduct federal income tax. The deduction is 50 per payroll and you pay the employee a gross pay of 1000 per biweekly pay period.

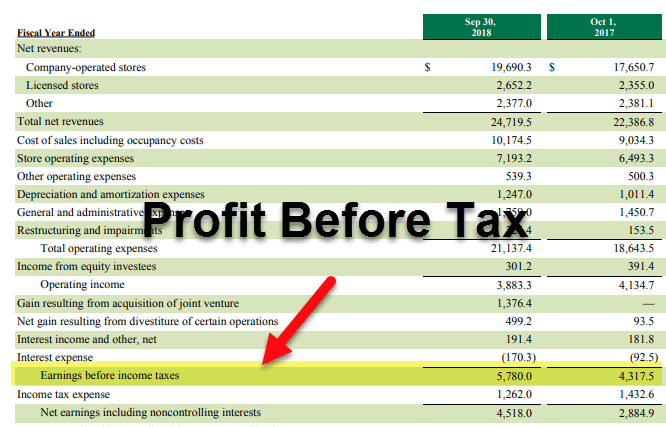

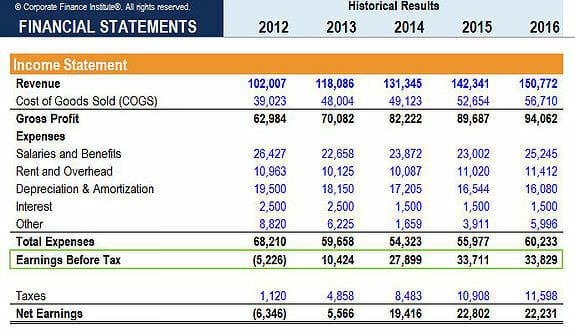

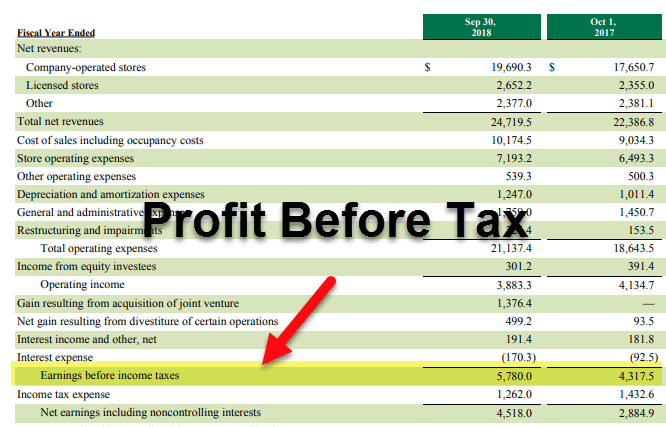

The pretax earnings is calculated by subtracting the operating and interest costs from the gross profit that is 100000 60000 40000. HSA Tax Savings Calculator. Adjust gross pay by withholding pre-tax contributions to health insurance 401 k retirement plans and other voluntary benefits.

Ad Enter Your Tax Information. If you are an employee of one of these organizations a 403b can be one of your best tools for creating a secure retirement. From there enter your annual contribution annual catch-up contribution and both the federal and state tax percentages.

Section 125 cafeteria plans. For instance on a Pre-EMI of Rs5 lakhs Rs 1 lakh will be depicted as tax deduction for the next 5 years. Assume your salary is 40000 and you invest 10 which equals 4000.

Say you have an employee with a pre-tax deduction. Calculate the employees gross wages Divide Saras annual salary by the number of times shes paid during the year. Calculating payroll deductions is the process of converting gross pay to net pay.

Earnings before Tax is calculated as Earnings before Tax EBIT Interest Earnings before Tax 50000 5000 Earnings before Tax 45000 Earnings before Tax is calculated as Earnings before Tax Net Profits Tax Earnings before Tax 42500 2500. Your pre-tax cash flow benefits therefore add up to 16800. Divide 45000 by 26 annual biweekly pay periods to arrive at biweekly gross salary of 173077.

Step 1 Calculate gross compensation for the pay period. Sometimes you or the employee might have the option to choose whether or not a benefit has pre-tax vs. First indicate if you are insuring just yourself or your family.

Your pre-tax income is. This permalink creates a unique url for this online calculator with your saved information. How do I calculate pre-tax.

Her gross pay for the period is 2000 48000 annual salary 24 pay periods. For example if you make 12 payments of 1400 over the course of the year that adds up to a debt service of 16800. How much should I have saved for retirement by 30.

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay. For example pre-tax deductions for retirement investment accounts such as a Roth IRA 401 k 403 b and health savings accounts. See How Much You Can Save With Our Free Tax Calculator.

When you make a pre-tax contribution to your retirement savings account you add the amount of the contribution to your account but your take home pay is reduced by less than the amount of your contribution. Whatever You Need Find it on Bark. You are required to calculate Earnings before tax using the information given below.

This is your annual net operating income NOI. Subtract the value of your debt service from your NOI. How much can pre-tax contributions reduce your taxes.

Discover Helpful Information And Resources On Taxes From AARP. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 23000 is 6200 more than 16800.

1000 50 950 The employees taxable income is 950 for the pay period. Some benefits can be either pre-tax or post-tax such as a pre-tax vs. For the given fiscal year FY the pretax earnings margin is 40000 500000 8.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. You can use the pre-tax profit margin to measure the operating efficiency of your company. Often the type of deduction you need to make is predefined in the policy for the benefit.

While shopping for health benefits plans for your employees you may consider either pre-tax or post-tax health insurance options. Gross compensation is your entire pay before deductions. On completion of the construction the total pre-EMI interest paid in the subsequent years is deductible in 5 equal instalments.

This amount must be included in the employees wages or reimbursed by the employee. Free Federal Filing for Everyone. Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income What is the pre-tax profit margin.

Earnings Before Tax Ebt What This Accounting Figure Really Means

Profit Before Tax Formula Examples How To Calculate Pbt

More Top Irs Audit Triggers To Avoid Infographic Irs Audit

E File Your Income Tax Returns In 5 Minutes On Cleartax Just Upload Your Form 16 And Cleartax Will Automatically Pre Tax Refund Filing Taxes Income Tax Return

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Profit Before Tax Formula Examples How To Calculate Pbt

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

New Year New Home Buying A New Home Home Buying New Homes

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

What Is Income Tax Income Tax Return Income Tax Tax Refund

Network Marketing Tax Benefits Google Search Direct Sales Business Business Tax Tax Deductions

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Pretax Income Definition Formula And Example Significance

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Cost Of Debt Kd Pre Tax And After Tax Formula With Excel Calculator

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Templates Federal Income Tax